If you’ve ever had one of those “ah-ha” moments in the middle of the night, thinking to yourself, “There’s got to be a better way to handle my finances,” you’re not alone. Over the years, I’ve found myself scrolling through endless apps, reading countless blog posts, and even attending webinars to figure out the best approach to managing my money.

And while the digital world offers no shortage of tools, a few really stand out—particularly when it comes to transforming how we manage, grow, and spend our hard-earned cash.

One platform that’s been catching my attention recently is BetterThisWorld Money. This digital financial tool has been making waves in the space by promising a smarter, more sustainable approach to managing personal and business finances.

But does it really deliver on its promises, or is it just another app claiming to simplify the complex world of money? Let’s dive in and find out!

What Is BetterThisWorld Money and Why Should You Care?

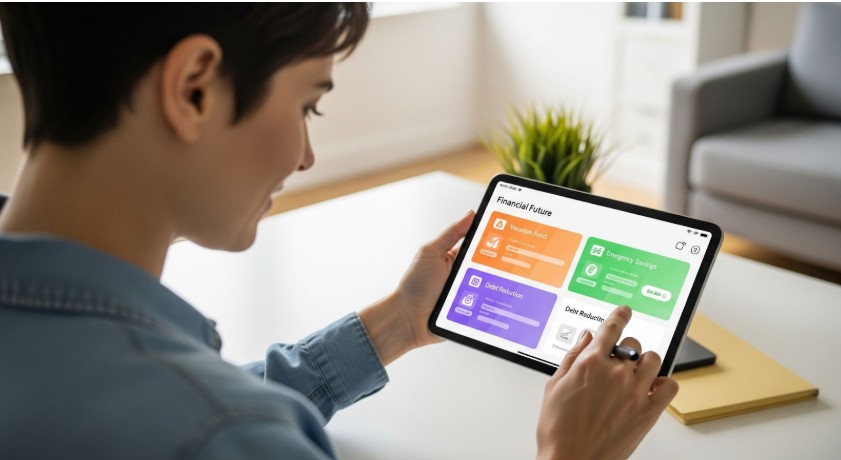

BetterThisWorld Money is not just another generic financial app. It combines the best of modern technology with some old-school wisdom to create a comprehensive platform for managing everything from budgeting to investing. What sets it apart from the sea of apps out there is its deep commitment to both personal finance management and helping users build a stronger financial future. Think of it as your financial planner, advisor, and wallet all in one, available at the touch of a button.

I first came across BetterThisWorld Money when I was seeking a more effective way to manage my personal finances while also exploring serious investing. What stood out to me was how well it bridged the gap between the two. Whether you’re just starting your financial journey or looking for ways to make your investments work harder, BetterThisWorld Money is here to guide you.

How Does BetterThisWorld Money Work?

The beauty of BetterThisWorld Money lies in its user-friendly interface and the ease with which it integrates your financial data. It starts with an initial setup, where you link all your accounts, from checking to credit cards and investment portfolios. Once connected, the platform analyzes your spending habits, identifies trends, and offers tailored insights to help you optimize your money.

Budgeting Made Simple

One of the standout features is its budgeting tool. Unlike other platforms that throw generic categories your way, BetterThisWorld Money uses a more intelligent approach. It creates personalized categories based on your actual spending habits. If you’re a frequent traveler or love dining out, the app will pick up on those patterns and automatically suggest ways to optimize those expenses. You can also set specific goals like saving for a vacation, paying down debt, or even funding an emergency savings account.

Investing Without the Headaches

When it comes to investing, BetterThisWorld Money doesn’t just throw you into the deep end. Instead, it provides a guided approach with easy-to-understand advice and portfolio suggestions. It even offers automated investing for those who may not feel confident choosing stocks and bonds. With a mixture of human-backed insight and machine learning algorithms, the app helps you make smarter investment choices, whether you’re a beginner or a seasoned investor.

How to Make the Most of BetterThisWorld Money

If you want to get the most out of BetterThisWorld Money, here’s how you can maximize its features to your advantage:

Set Clear Financial Goals

Before you dive in, take a moment to think about what you want to achieve financially. Are you looking to save for a big purchase, like a home or car? Or are you hoping to build a robust investment portfolio? Whatever your goals are, ensure you set them clearly within the app and let it help you stay on track.

Review Insights Regularly

BetterThisWorld Money isn’t just a static tool—it’s dynamic. The more you use it, the better it gets at providing personalized insights. Every month, take a moment to review the insights it provides and identify areas for improvement. You may find that a small adjustment to your spending can result in substantial savings over time.

Automate Your Investments

One of the easiest ways to start investing is through automation. With BetterThisWorld Money, you can set up automatic contributions to your investment accounts, ensuring that your money is always working for you. Plus, with its intelligent suggestions, you don’t have to worry about picking the wrong investments.

Stay Engaged with Notifications

BetterThisWorld Money sends timely notifications about your spending, upcoming bills, or investment opportunities. Stay engaged with these notifications, as they often provide opportunities to save more or make smarter spending choices in real-time.

Also Read: Who Pays Health Insurance on Disability?

Frequently Asked Questions About BetterThisWorld Money

Q1: Is BetterThisWorld Money really free to use?

Yes! BetterThisWorld Money offers a free version that gives you access to all the core features, including budgeting, financial insights, and automated investing. There is also a premium version with added features, such as tax management tools and personalized financial advice.

Q2: Can I link all my financial accounts to BetterThisWorld Money?

Absolutely. BetterThisWorld Money supports linking a wide variety of accounts, including bank accounts, credit cards, investment portfolios, and even PayPal. This allows you to see all your financial activity in one place.

Q3: Is BetterThisWorld Money safe to use?

Yes, BetterThisWorld Money uses top-notch encryption and security protocols to ensure that your financial data is safe and secure. They also provide multi-factor authentication for extra protection.

Q4: How accurate are the investment suggestions from BetterThisWorld Money?

While no platform can guarantee success in investing, BetterThisWorld Money uses both human insight and machine learning algorithms to provide accurate and personalized investment suggestions. It’s a great tool for beginner investors, but it’s always a good idea to consult with a professional advisor if you’re making major investment decisions.

Wrapping It Up: Should You Make the Switch to BetterThisWorld Money?

BetterThisWorld Money offers a refreshing, intelligent approach to personal finance management. Whether you’re looking to manage your spending, build an investment portfolio, or both, it’s a solid choice for those wanting to stay on top of their financial goals. As someone who has navigated the trials and tribulations of money management, I can confidently say that BetterThisWorld Money offers genuine value without the overwhelm.

The best part? It’s designed for everyone, from those just starting out to experienced investors. So, if you’re ready to take control of your finances and make smarter decisions every step of the way, BetterThisWorld Money could be the perfect fit.