When it comes to managing your financial health, understanding your credit score is crucial. Whether you are applying for a loan, renting an apartment, or even securing a job, your credit score plays a significant role. That’s where Gomyfinance.com comes in, offering a platform to check, monitor, and improve your credit score. In this article, we’ll dive into how the platform works and why it’s a helpful tool for financial management.

What is Gomyfinance.com?

Gomyfinance.com is an online platform that allows users to check and track their credit scores and credit reports. The site aggregates data from major credit bureaus such as Equifax, Experian, and TransUnion. It helps users understand their creditworthiness and provides insights into how their financial behavior affects their credit.

The platform is user-friendly, designed for individuals looking to stay updated on their credit status. By offering real-time access to credit scores, Gomyfinance.com enables users to make informed decisions about their financial future.

How Does Gomyfinance.com Credit Score Work?

Gomyfinance.com works by pulling your credit information from major credit bureaus. These agencies collect and store data about your financial history, including credit card usage, loan repayments, and payment history. The platform uses this data to generate a detailed credit report and credit score, giving you an overall picture of your financial health.

Once you log in to Gomyfinance.com, you can access your credit score and review the different factors that affect it. These might include your credit utilization rate, payment history, and recent credit inquiries.

What Are FICO and VantageScore?

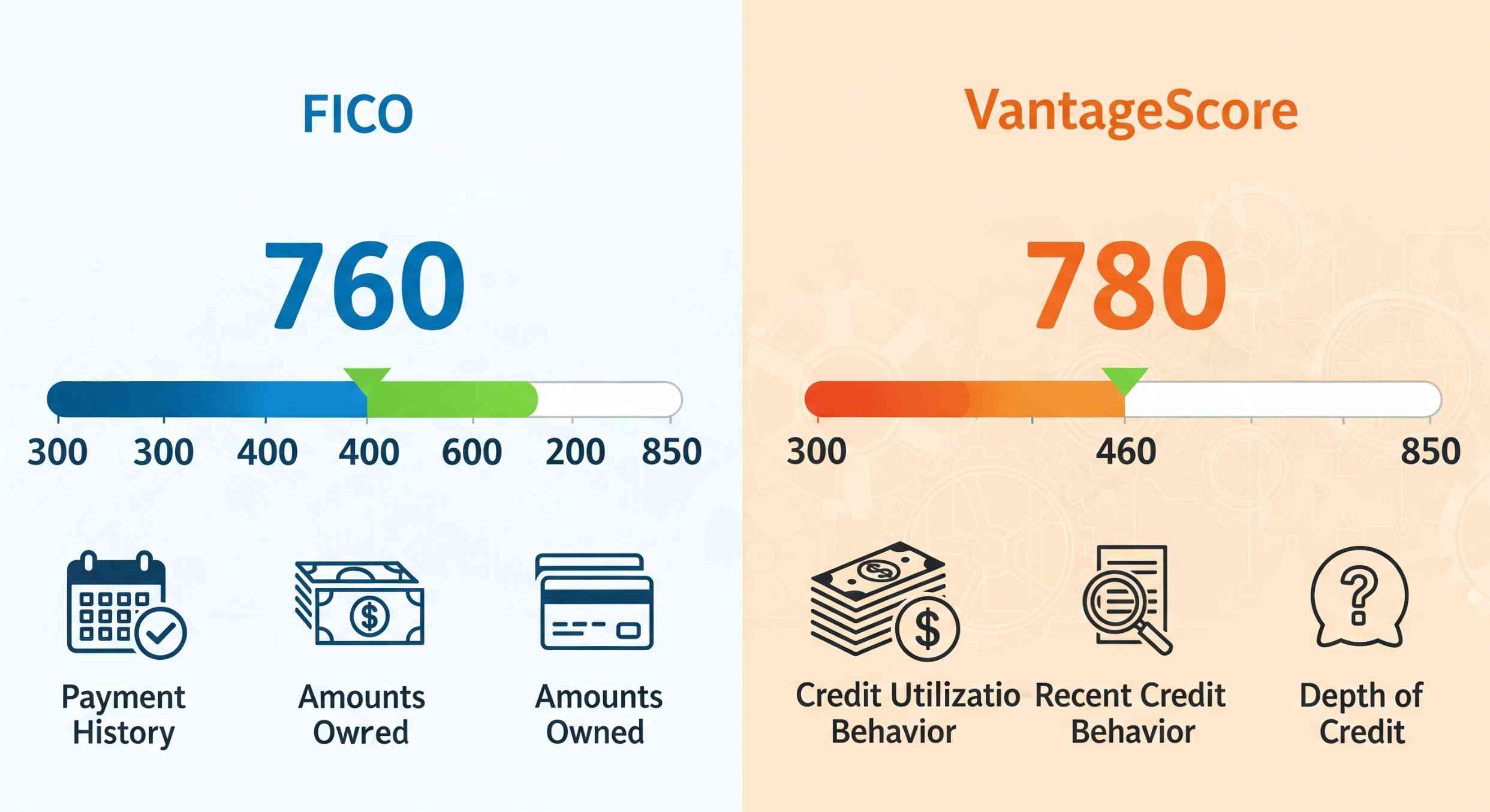

Gomyfinance.com uses FICO and VantageScore, the two most widely accepted credit scoring models. Both scores range from 300 to 850, with higher scores indicating better creditworthiness.

- FICO Score: The most commonly used scoring model by lenders. It assesses credit risk based on five factors: payment history, amounts owed, length of credit history, new credit, and types of credit used.

- VantageScore: Another popular model, used by some lenders and credit agencies. It works similarly to FICO but weighs factors like credit utilization a bit more heavily.

Understanding which model is being used by lenders can help you better manage and improve your score.

Why Is It Important to Check Your Credit Score Regularly?

Why Should You Monitor Your Credit Score?

Checking your credit score regularly gives you insight into your financial health and allows you to identify errors or fraudulent activity on your report. It’s important to keep track of any significant changes so that you can address them before they become problems. Additionally, monitoring your score helps you set financial goals and measure progress over time.

By reviewing your credit report, you can understand what factors are affecting your score. Whether it’s high credit utilization, missed payments, or too many recent inquiries, identifying the problem is the first step toward making improvements.

Can Regularly Checking Your Credit Score Help Improve It?

Yes, regular monitoring can help you stay on top of your financial behavior. If your credit score drops, you can take immediate action to address the issue. For example, if your score decreases due to high credit card balances, you can work to pay them down and improve your score. Gomyfinance.com provides tools that allow you to track this progress and stay motivated to maintain good credit.

Smarter Ways to Use Your Gomyfinance.com Credit Score

1. Log in Regularly

To stay informed, make it a habit to check your credit score monthly. Gomyfinance.com allows you to access your credit score easily, so set a reminder to log in and review your report. This will help you track your credit health and take action before any small issues grow into bigger problems.

2. Use the Analytics Tools

Gomyfinance.com offers interactive charts and technical indicators that can help you analyze your credit score. By using these tools, you can see which areas of your credit need the most attention. For example, the platform’s credit utilization tracker can show you if you’re using too much of your available credit, which can negatively impact your score.

3. Set Alerts for Key Changes

Another useful feature of Gomyfinance.com is the customizable alerts. These alerts can notify you of significant changes to your credit score or report. Setting up these alerts will help you stay proactive in managing your credit score and ensure you don’t miss any important updates.

4. Learn About Credit Management

Gomyfinance.com also provides educational resources to help you understand credit management better. The platform offers guides on topics like improving your credit score, reducing debt, and building a healthy credit history. Make sure to take advantage of these resources to educate yourself about credit and apply the tips to improve your score over time.

Also Read: Scoopupdates.com: Trending News, Tech & Lifestyle

FAQs About Gomyfinance.com Credit Score

Is Gomyfinance.com a Safe Platform to Check My Credit Score?

Yes, Gomyfinance.com uses secure encryption and two-factor authentication (2FA) to protect your personal data. However, always ensure that you’re using a secure connection and practice good online security habits, such as logging out when you’re done.

How Often Should I Check My Credit Score on Gomyfinance.com?

It’s recommended to check your credit score monthly to stay updated on any changes. Regular monitoring helps you spot errors or issues early, so you can address them before they negatively impact your financial health.

Can Gomyfinance.com Help Me Improve My Credit Score?

Yes, Gomyfinance.com provides tools and insights that can help you monitor and improve your credit score. The platform gives you a breakdown of the factors affecting your score, such as payment history and credit utilization, so you can focus on areas that need improvement.

What Do I Do If My Credit Score Drops?

If you notice a drop in your credit score, first review your credit report to identify the cause. Common reasons for a drop include missed payments, high credit card balances, or too many credit inquiries. Once you identify the issue, take action to correct it. Paying down debt, making payments on time, and reducing credit inquiries are all good ways to improve your score.

Conclusion: Gomyfinance.co A Smart Credit Tool

In today’s world, monitoring your credit score is more important than ever, and Gomyfinance.com offers a valuable tool for staying informed and taking control of your financial health. With easy access to your credit score, real-time alerts, and educational resources, this platform provides everything you need to track and improve your credit.

Whether you’re just starting out with credit or working to boost your score, Gomyfinance.com can help you stay on track. Just remember to combine the insights from the platform with information from other reputable sources and licensed advisors when making financial decisions.