Collecting has evolved far beyond hobby status—it’s become a legitimate wealth-building strategy for those who understand how to navigate specialty markets. While traditional investments like stocks and bonds dominate financial conversations, collectibles have quietly generated impressive returns for knowledgeable investors. From vintage guitars appreciating 5-10% annually to rare coins outperforming the S&P 500, collectors who approach their passion strategically often see substantial financial rewards.

The key lies in understanding that successful collecting requires more than enthusiasm. It demands market knowledge, timing, and the ability to identify undervalued items before they become mainstream. Here’s how experienced collectors systematically build wealth through specialty markets.

Research Market Trends and Historical Performance

Successful collectors don’t rely on intuition alone—they study market data extensively. Comic book collectors, for example, track sales data from major auction houses to identify which publishers, artists, or storylines consistently appreciate in value. A mint-condition Spider-Man #1 from 1963 sold for $454,000 in 2022, representing a compound annual growth rate of over 15% since its original 12-cent cover price.

Smart collectors utilize online databases, auction results, and price guides to understand market cycles. They recognize that collectible markets often follow predictable patterns: initial popularity, market saturation, decline, and eventual resurgence driven by nostalgia or renewed interest. This research helps them time their purchases and sales for maximum profit.

Focus on Quality Over Quantity

Wealthy collectors consistently prioritize condition and rarity over volume. A single high-grade collectible often outperforms dozens of lower-quality items. In the firearms collecting community, gun auction companies regularly see pristine examples of historical weapons command premium prices, while similar pieces in poor condition sell for fractions of their potential value.

This principle applies across all collecting categories. Watch collectors know that a mint-condition Rolex Daytona will always outperform multiple lesser timepieces. The same logic applies to art, stamps, coins, and memorabilia. Quality pieces also tend to be more liquid, meaning they’re easier to sell when market conditions are favorable.

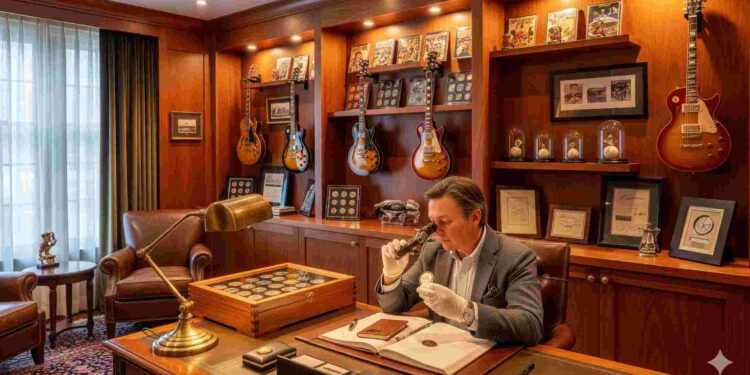

Develop Expertise in Niche Categories

The most successful collector-investors become genuine experts in their chosen fields. They understand manufacturing processes, historical context, and market nuances that casual collectors miss. This expertise allows them to spot undervalued pieces and avoid costly mistakes.

Vintage toy collectors, for instance, know which manufacturers used lead paint (affecting safety and value), which production runs had quality issues, and which variants are genuinely rare versus artificially scarce. This knowledge translates directly into profit when they can purchase items others overlook or avoid pieces with hidden problems that would destroy long-term value.

Time Market Entry and Exit Points

Understanding market psychology is crucial for building wealth through collectibles. Experienced collectors often buy during market downturns when prices are depressed and sellers are motivated. They also recognize when markets become overheated and it’s time to sell.

The baseball card market provides an excellent example. Savvy collectors who purchased cards during the market crash of the mid-1990s and held through the recent resurgence have seen incredible returns. A 1952 Topps Mickey Mantle card that might have sold for $5,000 in 1995 recently sold for over $5 million. Timing and patience proved more valuable than any other factor.

Authenticate and Document Everything

Professional collectors maintain meticulous records and ensure proper authentication for every significant piece. They understand that provenance and documentation can dramatically impact value. A Civil War sword with documented battle history and soldier identification commands far higher prices than similar weapons without provenance.

This documentation serves multiple purposes: it protects against fraud, provides insurance valuation support, and creates compelling stories that increase buyer interest. Collectors who skip this step often find their collections worth significantly less than expected when it’s time to sell.

Diversify Within and Across Categories

While specialization is important, successful collectors also understand diversification. They might focus on Depression-era glass but collect pieces from multiple manufacturers and patterns. This approach reduces risk while allowing them to capitalize on different market movements within their specialty.

Some collectors also diversify across completely different categories. A serious coin collector might also invest in vintage guitars or rare books. This strategy provides multiple income streams and reduces dependence on any single market’s performance.

Building wealth through collectibles requires treating your passion as a business. The most successful collectors combine genuine enthusiasm with rigorous research, quality focus, market timing, and professional documentation practices. When executed properly, this approach transforms collecting from an expensive hobby into a wealth-building strategy that provides both financial returns and personal satisfaction.